Headline

- Using a strategic mindset with global level public data offering potential explanation to stall in beer company stock price growth.

- A Python Jupyter notebook

- World Health Organization and World Bank API extraction

- Utilizes Bokeh for visualization

- Real world applied strategic analysis

Motivation

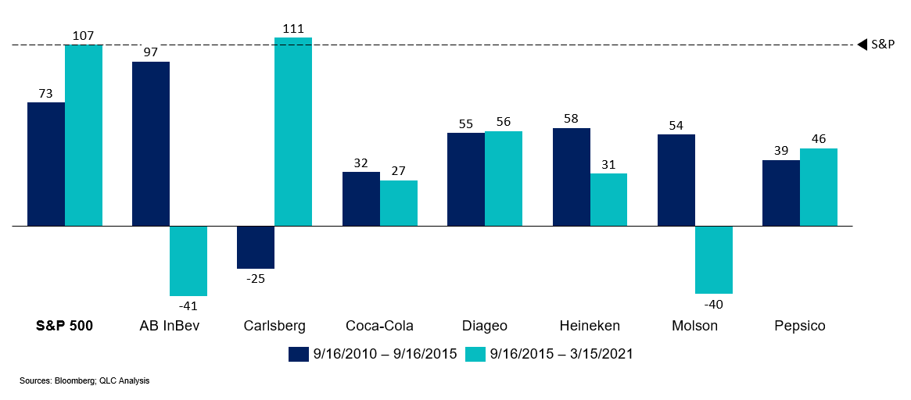

It is hard to discuss the past decade of global beverages industry without focusing on AB InBev. In the five years before the Megadeal fusing global brewing giants SABMiller and AB InBev (ABI), ABI outpaced SP500 returns by 24% percent. The nearest surviving player, Heineken, lagged by 19%. Since that time, ABI has not only lagged the SP500, but has lost value, close to 40% of the value of the firm at the time of the acquisition announcement.

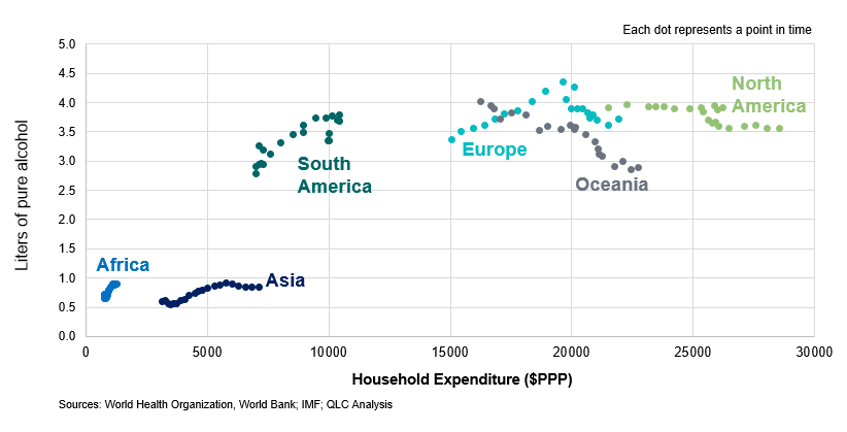

While there are numerous circumstances and peculiarities that help explain the drop, within the undercurrent are emerging secular trends that pose existential challenges to the global beverages industry. One such trend is the flattening of per capita consumption, illustrated below for beer.

This notebook will demonstrate how to (roughly) construct the above per capita consumption analysis using only publicly available data. While we don't use avant garde ML algorithms (in this analysis, at least), I hope that it demonstrates what can be done.

For many global consumer goods companies, this type of analysis forms the basis for their global strategies. A complete view usually requires more operational and granular insight that comes from proprietary data and knowledge from within the company. This is just a first step, but one that if taken with the right partner can lead to a coherent strategy and achievable success.

The full post can be found here on Quantum Logik's website