-

Notifications

You must be signed in to change notification settings - Fork 5.4k

Description

❓ Questions and Help

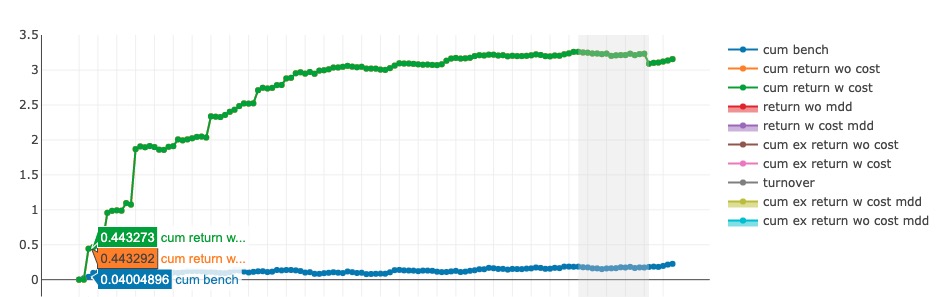

I used wind's market data, (open close low high vwap) are adjusted in a post-weighted way, factor = adjusted_price / original_price, when I am using the close price for backtesting, everything looks normal, daily return are less than 10%, but when I am using vwap for backtesting, the results will become strange, some daily returns are greater than 10%

I checked the backtest detail: positions = recorder.load_object("portfolio_analysis/positions_normal.pkl")

{Timestamp('2020-07-02 00:00:00'): {'cash': 100000000, 'today_account_value': 100000000}, Timestamp('2020-07-03 00:00:00'): {'cash': 96198100.0, 'today_account_value': 144327301.40487388, 'SZ000661': {'count': 1, 'amount': 4684.182645143626, 'price': 3047.1298828125, 'weight': 0.09889544649995681}, 'SH600340': {'count': 1, 'amount': 76828.21035849101, 'price': 440.6700134277344, 'weight': 0.23457716011283875}}, ......

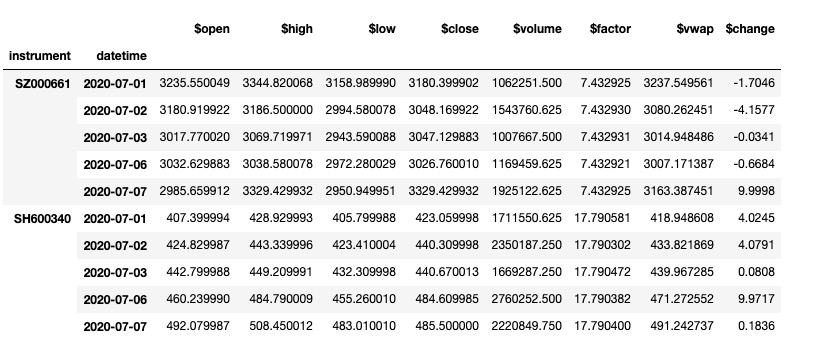

And found some abnormal data:

It seems like the today_account_value is calculate by close * amount:

96198100.0 + 4684.1826451436263047.1298828125 + 76828.21035849101440.6700134277344 - 144327301.40487388

And buy stock with vwap/factor:

96198100.0 + 4684.1826451436263014.948486/7.432931 + 76828.21035849101439.967285/17.790472 - 100000000

market data of ['SZ000661', 'SH600340']:

I want to know what I used wrong...

Thanks for your reply~