📊 Dataset Info Model trained on a real-world dataset with ~6 million legitimate transactions and ~9,000 fraudulent cases — showcasing severe class imbalance (~0.15% fraud rate).

Detecting fraudulent financial transactions using feature engineering, LightGBM, CatBoost, SMOTE, and evaluation visualizations.

You can try the app live here:

🌐 Click to open Smart Fraud Detection App

fraud-detection/

├── data/ ← (optional) zipped dataset or ignored raw data

├── images/ ← Images used in reporting or Streamlit

├── mlruns/ ← MLFlow tracking (excluded from Git)

├── notebook/

│ ├── EDA.ipynb ← Exploratory Data Analysis

│ ├── build_model.ipynb ← Step-by-step experimentation

│ └── sampled_5m_with_fraud.csv ← Sample dataset (if not ignored)

├── src/

│ ├── data/

│ │ └── preprocessing.py ← Preprocessing + feature engineering

│ ├── models/

│ │ ├── train_model.py ← Model training script

│ │ └── *.pkl ← Saved models (CatBoost / LGBM)

│ ├── utils/

│ │ └── metrics.py ← Evaluation metrics and plots

│ └── init.py

├── app.py ← Streamlit dashboard entry point

├── explainder_dashboard.py ← SHAP + feature importance visualizer

├── main.py ← Full training pipeline

├── requirements.txt

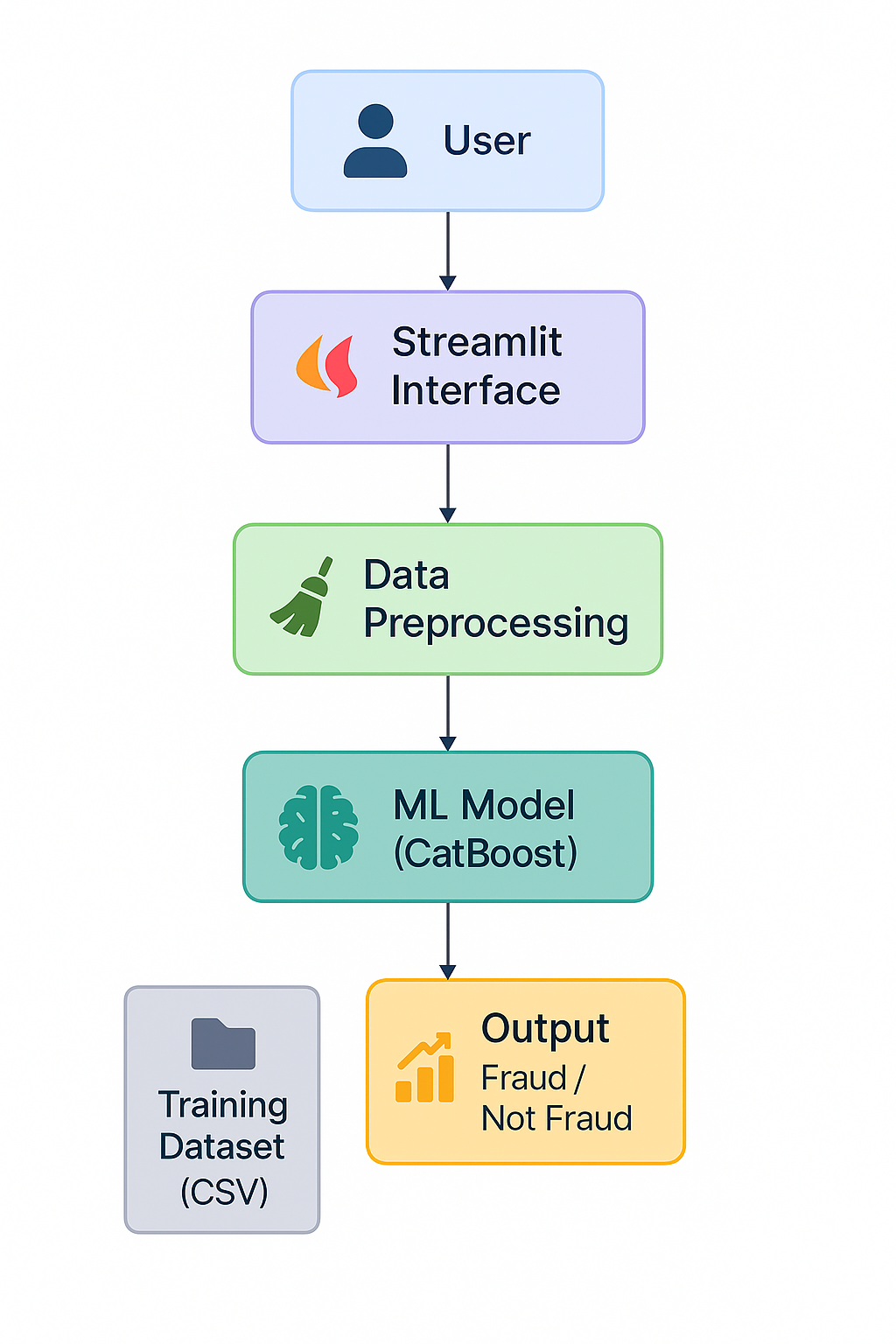

└── README.mdThis flowchart shows how different components of the system (user interface, data preprocessing, ML model, and output) are connected in the pipeline.

✅ End-to-End Pipeline: Covers everything from EDA to a deployment-ready model — modular and production-oriented structure using src/ architecture.

📈 Model Types:

LightGBM with tuned parameters

CatBoost for additional benchmarking

⚙️ Feature Engineering: Created domain-informed features to capture fraud behavior and anomalies:

python Copy Edit errorBalanceOrig = newbalanceOrig + amount - oldbalanceOrg errorBalanceDest = oldbalanceDest + amount - newbalanceDest diffOrig = oldbalanceOrg - newbalanceOrig diffDest = newbalanceDest - oldbalanceDest is_orig_empty_after = (newbalanceOrig == 0).astype(int) is_dest_empty_before = (oldbalanceDest == 0).astype(int) large_amount_flag = (amount > amount.quantile(0.99)).astype(int) ratio_amount_balance = amount / (oldbalanceOrg + 1) These features help the model capture patterns like:

Unusual balance changes

Empty sender/receiver accounts

Abnormal transaction volumes

🚦 Evaluation Results:

Metric Score Accuracy ~0.99 Precision ~0.99 Recall ~0.99 F1-Score ~0.99

Validated with 5-fold Stratified Cross-Validation and visualized using ROC AUC, confusion matrix, and precision-recall curves.

📊 Visual Tools:

explainder_dashboard.py: SHAP-based feature importance visualizer

evaluate.py: Generates ROC, PR, and confusion matrix plots

app.py: Streamlit dashboard for real-time prediction

🚀 Getting Started bash Copy Edit

git clone https://github.com/mehdighelich1379/Smart-Fraud-Detection.git cd Smart-Fraud-Detection

pip install -r requirements.txt

streamlit run app.py

❗ Source Code Restrictions

Data preprocessing (src/data/preprocessing.py)

Model training (src/models/train_model.py)

Evaluation functions (src/utils/metrics.py)

has been intentionally excluded from this repository.

✅ You can still explore the trained model, interactive dashboard, and visual results to evaluate the project.

If you’re a recruiter/employer and need access to the full pipeline for validation, please contact me at: 📧 ghelichmehdi1@gmail.com

🛠️ Tech Stack Languages: Python, Jupyter Notebook

ML Libraries: LightGBM, CatBoost, Scikit-learn, SMOTE

Visualization: Matplotlib, Seaborn, SHAP

Experiment Tracking: MLFlow

Deployment: Streamlit

📝 Final Thoughts This project demonstrates how a structured, feature-driven, and iterative pipeline can achieve near-perfect performance in fraud detection — even with highly imbalanced datasets.

It is adaptable to other anomaly detection tasks such as customer churn, insurance fraud, or health risk prediction.