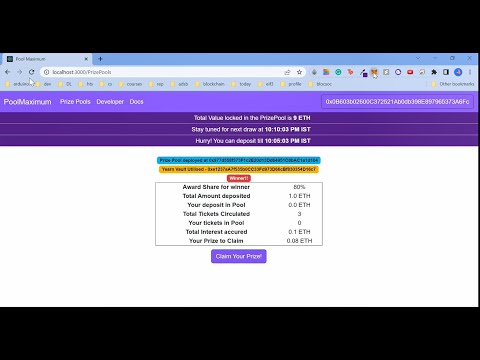

Pool Maximum is a DeFi protocol that pools user funds, maximizes yield, and randomly distributes a majority percentage of the interest earned to a winner, while the rest is proportionally distributed to the losers.

-

Users deposit ETH into prize pool before deadline.

-

Prize pool deposits funds into Yearn Finance vault, distributing tickets to users.

-

Prize pool burns shares and withdraws the amount and interest after a certain time.

-

Random user chosen as winner, receiving initial principal plus majority of interest.

-

Losers receive initial principal plus rest of interest divided by total tickets minted in the pool-maximum till date.

As you can see that the idea is inspired from the PoolTogether protocol but it is better in the following ways:

-

The interest earned is maximized using the yearn finance vaults.

-

No user goes profitless and receives prizes based on their loyalty to the protocol.

The above DeFi protocol can solve several problems faced by users and investors in the current financial system. Here are some of the problems this protocol can solve:

-

This DeFi protocol allows investors to pool their funds together and invest in yearn finance vaults, providing them with the opportunity to earn maximum yield.

-

This protocol creates a fair distribution of interest earnings, where the winner is chosen randomly, and the rest is proportionally distributed to all participants based on their contribution.

-

This protocol provides an open and accessible platform for anyone to participate in investment opportunities and provides transparency and traceability to the entire investment process.

-

The protocol also gives liberty to deploy customised pools with your choice of yearn vault, prize distribution strategy, award share to be given to winner and much more flexibility.