#Visual story telling part 1: green buildings

green = read.csv('https://raw.githubusercontent.com/jgscott/STA380/master/data/greenbuildings.csv', header=T)#Let us use the log response

rent_all <- log(green$Rent)

#subset of dataset for simplicity, dont do this try to include all in dataset

all_sub <- green[,-c(0,1,2,3)] # lose lmedval and the room totals

n = dim(all_sub)[1] #Sample size

tr = sample(1:n, #Sample indices do be used in training

size = 3000, #Sample will have 5000 observation

replace = FALSE) #Without replacement

#Create a full matrix of interactions (only necessary for linear model)

#Do the normalization only for main variables.

xxall_rent_sub <- model.matrix(~., data=data.frame(scale(all_sub)))[,-1] # the . syntax multiplies data by each long and lat, and then by both

allData = data.frame(rent_all,all_sub)

#Two models initially, sets the scope/boundaries for search

null = lm(rent_all~1, data=allData[tr,]) #only has an intercept

full = glm(rent_all~., data=allData[tr,]) #Has all the selected variables

#Let us select models by stepwise

regBack = step(full, #Starting with the full model

direction="backward", #And deleting variables

k=log(length(tr))) #This is BIC## Start: AIC=-2358.4

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + Energystar + green_rating + net +

## amenities + cd_total_07 + hd_total07 + total_dd_07 + Precipitation +

## Gas_Costs + Electricity_Costs + cluster_rent

##

##

## Step: AIC=-2358.4

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + Energystar + green_rating + net +

## amenities + cd_total_07 + hd_total07 + Precipitation + Gas_Costs +

## Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - green_rating 1 74.704 -2366.32

## - Energystar 1 74.705 -2366.27

## - Precipitation 1 74.707 -2366.23

## - net 1 74.709 -2366.13

## - LEED 1 74.711 -2366.05

## - stories 1 74.724 -2365.53

## - renovated 1 74.801 -2362.48

## - class_b 1 74.853 -2360.39

## <none> 74.702 -2358.40

## - Gas_Costs 1 74.928 -2357.40

## - leasing_rate 1 74.970 -2355.75

## - amenities 1 75.016 -2353.91

## - class_a 1 75.042 -2352.91

## - empl_gr 1 75.160 -2348.23

## - Electricity_Costs 1 75.629 -2329.71

## - age 1 75.747 -2325.07

## - cd_total_07 1 78.743 -2209.63

## - hd_total07 1 79.122 -2195.32

## - cluster_rent 1 81.261 -2115.95

## - Rent 1 194.819 486.28

##

## Step: AIC=-2366.32

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + Energystar + net + amenities +

## cd_total_07 + hd_total07 + Precipitation + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - Precipitation 1 74.709 -2374.14

## - net 1 74.712 -2374.03

## - Energystar 1 74.714 -2373.92

## - LEED 1 74.721 -2373.66

## - stories 1 74.726 -2373.44

## - renovated 1 74.803 -2370.39

## - class_b 1 74.855 -2368.31

## <none> 74.704 -2366.32

## - Gas_Costs 1 74.932 -2365.28

## - leasing_rate 1 74.971 -2363.70

## - amenities 1 75.021 -2361.74

## - class_a 1 75.044 -2360.83

## - empl_gr 1 75.162 -2356.15

## - Electricity_Costs 1 75.631 -2337.63

## - age 1 75.748 -2333.05

## - cd_total_07 1 78.746 -2217.53

## - hd_total07 1 79.123 -2203.32

## - cluster_rent 1 81.273 -2123.51

## - Rent 1 194.835 478.51

##

## Step: AIC=-2374.14

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + Energystar + net + amenities +

## cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - net 1 74.717 -2381.83

## - Energystar 1 74.719 -2381.73

## - LEED 1 74.725 -2381.49

## - stories 1 74.734 -2381.14

## - renovated 1 74.807 -2378.25

## - class_b 1 74.868 -2375.81

## <none> 74.709 -2374.14

## - leasing_rate 1 74.980 -2371.36

## - amenities 1 75.022 -2369.70

## - Gas_Costs 1 75.026 -2369.55

## - class_a 1 75.056 -2368.34

## - empl_gr 1 75.325 -2357.70

## - age 1 75.769 -2340.20

## - Electricity_Costs 1 75.799 -2339.05

## - cd_total_07 1 78.819 -2222.77

## - hd_total07 1 79.137 -2210.79

## - cluster_rent 1 81.899 -2108.67

## - Rent 1 194.843 470.63

##

## Step: AIC=-2381.83

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + Energystar + amenities + cd_total_07 +

## hd_total07 + Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - Energystar 1 74.728 -2389.4

## - LEED 1 74.734 -2389.2

## - stories 1 74.740 -2388.9

## - renovated 1 74.814 -2386.0

## - class_b 1 74.876 -2383.5

## <none> 74.717 -2381.8

## - leasing_rate 1 74.989 -2379.0

## - amenities 1 75.027 -2377.5

## - Gas_Costs 1 75.040 -2377.0

## - class_a 1 75.069 -2375.9

## - empl_gr 1 75.331 -2365.5

## - age 1 75.786 -2347.5

## - Electricity_Costs 1 75.799 -2347.1

## - cd_total_07 1 78.821 -2230.7

## - hd_total07 1 79.140 -2218.7

## - cluster_rent 1 81.902 -2116.6

## - Rent 1 194.927 463.9

##

## Step: AIC=-2389.4

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + LEED + amenities + cd_total_07 + hd_total07 +

## Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - LEED 1 74.745 -2396.72

## - stories 1 74.754 -2396.35

## - renovated 1 74.824 -2393.59

## - class_b 1 74.889 -2391.00

## <none> 74.728 -2389.40

## - leasing_rate 1 75.008 -2386.26

## - amenities 1 75.041 -2384.94

## - Gas_Costs 1 75.042 -2384.92

## - class_a 1 75.103 -2382.50

## - empl_gr 1 75.335 -2373.31

## - Electricity_Costs 1 75.807 -2354.73

## - age 1 75.809 -2354.64

## - cd_total_07 1 78.823 -2238.62

## - hd_total07 1 79.162 -2225.86

## - cluster_rent 1 81.907 -2124.43

## - Rent 1 195.248 460.81

##

## Step: AIC=-2396.72

## rent_all ~ empl_gr + Rent + leasing_rate + stories + age + renovated +

## class_a + class_b + amenities + cd_total_07 + hd_total07 +

## Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - stories 1 74.772 -2403.65

## - renovated 1 74.842 -2400.87

## - class_b 1 74.908 -2398.25

## <none> 74.745 -2396.72

## - leasing_rate 1 75.026 -2393.54

## - amenities 1 75.054 -2392.45

## - Gas_Costs 1 75.065 -2392.02

## - class_a 1 75.127 -2389.56

## - empl_gr 1 75.350 -2380.72

## - age 1 75.828 -2361.90

## - Electricity_Costs 1 75.834 -2361.68

## - cd_total_07 1 78.851 -2245.59

## - hd_total07 1 79.186 -2232.96

## - cluster_rent 1 81.908 -2132.38

## - Rent 1 195.652 458.94

##

## Step: AIC=-2403.65

## rent_all ~ empl_gr + Rent + leasing_rate + age + renovated +

## class_a + class_b + amenities + cd_total_07 + hd_total07 +

## Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - renovated 1 74.861 -2408.14

## - class_b 1 74.928 -2405.46

## <none> 74.772 -2403.65

## - leasing_rate 1 75.040 -2401.00

## - amenities 1 75.056 -2400.37

## - Gas_Costs 1 75.094 -2398.86

## - class_a 1 75.127 -2397.55

## - empl_gr 1 75.393 -2387.05

## - age 1 75.881 -2367.85

## - Electricity_Costs 1 75.888 -2367.55

## - cd_total_07 1 78.982 -2248.65

## - hd_total07 1 79.512 -2228.74

## - cluster_rent 1 82.073 -2134.40

## - Rent 1 196.119 458.04

##

## Step: AIC=-2408.14

## rent_all ~ empl_gr + Rent + leasing_rate + age + class_a + class_b +

## amenities + cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - class_b 1 75.040 -2409.01

## <none> 74.861 -2408.14

## - leasing_rate 1 75.145 -2404.85

## - amenities 1 75.171 -2403.83

## - Gas_Costs 1 75.198 -2402.77

## - class_a 1 75.262 -2400.23

## - empl_gr 1 75.468 -2392.09

## - age 1 75.923 -2374.20

## - Electricity_Costs 1 76.047 -2369.36

## - cd_total_07 1 79.128 -2251.16

## - hd_total07 1 79.788 -2226.45

## - cluster_rent 1 82.106 -2141.20

## - Rent 1 196.122 450.07

##

## Step: AIC=-2409.01

## rent_all ~ empl_gr + Rent + leasing_rate + age + class_a + amenities +

## cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## <none> 75.040 -2409.0

## - class_a 1 75.266 -2408.1

## - Gas_Costs 1 75.383 -2403.4

## - leasing_rate 1 75.388 -2403.3

## - amenities 1 75.404 -2402.6

## - empl_gr 1 75.671 -2392.1

## - Electricity_Costs 1 76.217 -2370.7

## - age 1 76.353 -2365.4

## - cd_total_07 1 79.395 -2249.1

## - hd_total07 1 79.911 -2229.8

## - cluster_rent 1 82.222 -2145.0

## - Rent 1 197.141 457.5

regForward = step(null, #The most simple model

scope=formula(full), #The most complicated model

direction="both", #Add or delete variables

k=log(length(tr))) #This is BIC## Start: AIC=-4747.59

## rent_all ~ 1

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2976/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + Rent 1 513.67 98.05 -10140.8

## + cluster_rent 1 386.29 225.43 -7663.1

## + Electricity_Costs 1 111.46 500.25 -5290.9

## + total_dd_07 1 93.10 518.62 -5183.6

## + hd_total07 1 46.65 565.07 -4928.3

## + class_a 1 37.37 574.35 -4879.8

## + cd_total_07 1 26.08 585.64 -4821.9

## + leasing_rate 1 25.36 586.36 -4818.2

## + age 1 16.67 595.04 -4774.5

## + renovated 1 11.41 600.30 -4748.3

## + class_b 1 10.18 601.54 -4742.1

## + amenities 1 4.14 607.57 -4712.5

## + green_rating 1 2.62 609.09 -4705.0

## + net 1 2.32 609.40 -4703.5

## + Energystar 1 2.26 609.45 -4703.3

## + stories 1 1.70 610.01 -4700.5

## <none> 611.71 -4700.2

## + LEED 1 0.41 611.30 -4694.2

## + Gas_Costs 1 0.15 611.56 -4693.0

## + empl_gr 1 0.08 611.63 -4692.6

## + Precipitation 1 0.00 611.71 -4692.2

##

## Step: AIC=-10240.28

## rent_all ~ Rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2976/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + cluster_rent 1 9.83 88.22 -10447.2

## + total_dd_07 1 9.81 88.24 -10446.4

## + hd_total07 1 5.84 92.20 -10315.6

## <none> 98.26 -10240.3

## + age 1 3.26 94.79 -10233.3

## + Electricity_Costs 1 2.15 95.89 -10198.9

## + class_a 1 2.01 96.03 -10194.6

## + cd_total_07 1 1.33 96.71 -10173.5

## + leasing_rate 1 0.98 97.06 -10162.7

## + Precipitation 1 0.77 97.28 -10156.1

## + amenities 1 0.55 97.50 -10149.4

## + class_b 1 0.36 97.68 -10143.9

## + Gas_Costs 1 0.25 97.80 -10140.3

## + Energystar 1 0.23 97.81 -10139.9

## + green_rating 1 0.23 97.81 -10139.8

## + renovated 1 0.16 97.89 -10137.5

## + empl_gr 1 0.12 97.92 -10136.5

## + stories 1 0.10 97.95 -10135.8

## + net 1 0.01 98.04 -10133.0

## + LEED 1 0.01 98.04 -10132.9

## - Rent 1 516.46 614.72 -4747.6

##

## Step: AIC=-10545.3

## rent_all ~ Rent + cluster_rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2976/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + total_dd_07 1 5.762 82.453 -10640.2

## + age 1 4.213 84.003 -10584.8

## + hd_total07 1 3.479 84.737 -10558.9

## <none> 88.523 -10545.3

## + class_a 1 2.760 85.455 -10533.8

## + amenities 1 1.312 86.903 -10483.8

## + Precipitation 1 1.159 87.057 -10478.5

## + leasing_rate 1 0.808 87.408 -10466.6

## + cd_total_07 1 0.614 87.601 -10460.0

## + green_rating 1 0.573 87.642 -10458.6

## + Energystar 1 0.530 87.685 -10457.1

## + class_b 1 0.472 87.743 -10455.2

## + Gas_Costs 1 0.374 87.842 -10451.8

## + Electricity_Costs 1 0.218 87.998 -10446.5

## + empl_gr 1 0.184 88.031 -10445.4

## + renovated 1 0.106 88.109 -10442.8

## + LEED 1 0.045 88.170 -10440.7

## + stories 1 0.041 88.174 -10440.6

## + net 1 0.008 88.207 -10439.5

## - cluster_rent 1 9.736 98.259 -10240.3

## - Rent 1 138.464 226.987 -7728.4

##

## Step: AIC=-10737.11

## rent_all ~ Rent + cluster_rent + total_dd_07

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2976/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + age 1 3.178 79.276 -10749.2

## <none> 82.819 -10737.1

## + class_a 1 2.624 79.829 -10728.5

## + amenities 1 2.019 80.434 -10706.0

## + Electricity_Costs 1 1.833 80.620 -10699.1

## + leasing_rate 1 1.051 81.402 -10670.4

## + stories 1 0.508 81.945 -10650.6

## + class_b 1 0.398 82.055 -10646.6

## + empl_gr 1 0.395 82.058 -10646.5

## + green_rating 1 0.355 82.098 -10645.1

## + Energystar 1 0.317 82.136 -10643.7

## + renovated 1 0.065 82.388 -10634.6

## + cd_total_07 1 0.059 82.394 -10634.3

## + hd_total07 1 0.059 82.394 -10634.3

## + LEED 1 0.054 82.399 -10634.2

## + net 1 0.028 82.426 -10633.2

## + Gas_Costs 1 0.025 82.428 -10633.1

## + Precipitation 1 0.000 82.453 -10632.2

## - total_dd_07 1 5.704 88.523 -10545.3

## - cluster_rent 1 5.772 88.591 -10543.0

## - Rent 1 138.937 221.756 -7790.4

##

## Step: AIC=-10843.71

## rent_all ~ Rent + cluster_rent + total_dd_07 + age

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2976/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## <none> 79.715 -10843.7

## + Electricity_Costs 1 1.795 77.481 -10809.3

## + amenities 1 0.996 78.279 -10778.8

## + class_a 1 0.720 78.556 -10768.3

## + leasing_rate 1 0.669 78.606 -10766.4

## + cd_total_07 1 0.584 78.692 -10763.2

## + hd_total07 1 0.584 78.692 -10763.2

## + renovated 1 0.387 78.889 -10755.7

## + empl_gr 1 0.224 79.052 -10749.6

## + stories 1 0.189 79.087 -10748.3

## + Gas_Costs 1 0.131 79.145 -10746.1

## + green_rating 1 0.059 79.217 -10743.4

## + Energystar 1 0.044 79.232 -10742.8

## + class_b 1 0.038 79.238 -10742.6

## + LEED 1 0.037 79.239 -10742.5

## + net 1 0.002 79.274 -10741.2

## + Precipitation 1 0.000 79.275 -10741.2

## - age 1 3.104 82.819 -10737.1

## - total_dd_07 1 4.671 84.386 -10680.9

## - cluster_rent 1 6.635 86.350 -10611.9

## - Rent 1 131.645 211.360 -7926.4

#the total number of degree days (either heating or cooling) in the building's region in 2007.# Extract the buildings with green ratings

green_only = subset(green, green_rating==1)#Let us use the log response

green_rent <- log(green_only$Rent)

#subset of dataset for simplicity, dont do this try to include all in dataset

green_rent_sub <- green_only[,-c(0,1,2,3)] # lose lmedval and the room totals

n = dim(green_rent_sub)[1] #Sample size

tr = sample(1:n, #Sample indices do be used in training

size = 300, #Sample will have 5000 observation

replace = FALSE) #Without replacement

#Create a full matrix of interactions (only necessary for linear model)

#Do the normalization only for main variables.

xxgreen_rent_sub <- model.matrix(~., data=data.frame(scale(green_rent_sub)))[,-1] # the . syntax multiplies data by each long and lat, and then by both

greenData = data.frame(green_rent,green_rent_sub)

#Two models initially, sets the scope/boundaries for search

null = lm(green_rent~1, data=greenData[tr,]) #only has an intercept

full = glm(green_rent~., data=greenData[tr,]) #Has all the selected variables

#Let us select models by stepwise

regBack = step(full, #Starting with the full model

direction="backward", #And deleting variables

k=log(length(tr))) #This is BIC## Start: AIC=-363.05

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + green_rating +

## net + amenities + cd_total_07 + hd_total07 + total_dd_07 +

## Precipitation + Gas_Costs + Electricity_Costs + cluster_rent

##

##

## Step: AIC=-363.05

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + green_rating +

## net + amenities + cd_total_07 + hd_total07 + Precipitation +

## Gas_Costs + Electricity_Costs + cluster_rent

##

##

## Step: AIC=-363.05

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + net +

## amenities + cd_total_07 + hd_total07 + Precipitation + Gas_Costs +

## Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - Precipitation 1 3.5320 -368.75

## - net 1 3.5321 -368.74

## - LEED 1 3.5325 -368.70

## - leasing_rate 1 3.5326 -368.70

## - Gas_Costs 1 3.5328 -368.68

## - stories 1 3.5358 -368.43

## - Energystar 1 3.5383 -368.22

## - class_b 1 3.5428 -367.84

## - class_a 1 3.5443 -367.72

## - renovated 1 3.5468 -367.51

## - amenities 1 3.5514 -367.12

## <none> 3.5320 -363.05

## - empl_gr 1 3.6273 -360.84

## - Electricity_Costs 1 3.6756 -356.91

## - age 1 3.7146 -353.78

## - cluster_rent 1 3.9247 -337.44

## - cd_total_07 1 4.0012 -331.70

## - hd_total07 1 4.1182 -323.14

## - Rent 1 8.9326 -93.18

##

## Step: AIC=-368.75

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + net +

## amenities + cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - net 1 3.5321 -374.44

## - LEED 1 3.5325 -374.41

## - leasing_rate 1 3.5326 -374.40

## - Gas_Costs 1 3.5337 -374.31

## - stories 1 3.5358 -374.13

## - Energystar 1 3.5385 -373.91

## - class_b 1 3.5429 -373.53

## - class_a 1 3.5445 -373.40

## - renovated 1 3.5469 -373.20

## - amenities 1 3.5514 -372.82

## <none> 3.5320 -368.75

## - empl_gr 1 3.6715 -362.95

## - Electricity_Costs 1 3.6999 -360.66

## - age 1 3.7158 -359.39

## - cluster_rent 1 3.9274 -342.94

## - cd_total_07 1 4.0082 -336.89

## - hd_total07 1 4.1221 -328.57

## - Rent 1 8.9934 -96.87

##

## Step: AIC=-374.44

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + amenities +

## cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - LEED 1 3.5326 -380.10

## - leasing_rate 1 3.5327 -380.09

## - Gas_Costs 1 3.5339 -380.00

## - stories 1 3.5358 -379.83

## - Energystar 1 3.5387 -379.59

## - class_b 1 3.5431 -379.22

## - class_a 1 3.5447 -379.09

## - renovated 1 3.5471 -378.89

## - amenities 1 3.5515 -378.52

## <none> 3.5321 -374.44

## - empl_gr 1 3.6732 -368.51

## - Electricity_Costs 1 3.7004 -366.32

## - age 1 3.7158 -365.09

## - cluster_rent 1 3.9274 -348.64

## - cd_total_07 1 4.0226 -341.53

## - hd_total07 1 4.1251 -334.05

## - Rent 1 9.0068 -102.13

##

## Step: AIC=-380.1

## green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + Energystar + amenities +

## cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - leasing_rate 1 3.5332 -385.76

## - Gas_Costs 1 3.5346 -385.64

## - stories 1 3.5363 -385.50

## - class_b 1 3.5436 -384.89

## - class_a 1 3.5452 -384.75

## - renovated 1 3.5478 -384.53

## - amenities 1 3.5522 -384.16

## - Energystar 1 3.5612 -383.41

## <none> 3.5326 -380.10

## - empl_gr 1 3.6740 -374.15

## - Electricity_Costs 1 3.7015 -371.94

## - age 1 3.7160 -370.78

## - cluster_rent 1 3.9274 -354.34

## - cd_total_07 1 4.0262 -346.96

## - hd_total07 1 4.1260 -339.69

## - Rent 1 9.0365 -106.86

##

## Step: AIC=-385.76

## green_rent ~ empl_gr + Rent + stories + age + renovated + class_a +

## class_b + Energystar + amenities + cd_total_07 + hd_total07 +

## Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - Gas_Costs 1 3.5351 -391.30

## - stories 1 3.5368 -391.16

## - class_b 1 3.5442 -390.53

## - class_a 1 3.5460 -390.39

## - renovated 1 3.5495 -390.09

## - amenities 1 3.5530 -389.80

## - Energystar 1 3.5618 -389.06

## <none> 3.5332 -385.76

## - empl_gr 1 3.6747 -379.80

## - Electricity_Costs 1 3.7015 -377.64

## - age 1 3.7212 -376.07

## - cluster_rent 1 3.9274 -360.05

## - cd_total_07 1 4.0271 -352.60

## - hd_total07 1 4.1274 -345.30

## - Rent 1 9.0415 -112.39

##

## Step: AIC=-391.3

## green_rent ~ empl_gr + Rent + stories + age + renovated + class_a +

## class_b + Energystar + amenities + cd_total_07 + hd_total07 +

## Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - stories 1 3.5384 -396.73

## - class_b 1 3.5463 -396.06

## - class_a 1 3.5480 -395.92

## - renovated 1 3.5508 -395.69

## - amenities 1 3.5555 -395.30

## - Energystar 1 3.5697 -394.11

## <none> 3.5351 -391.30

## - empl_gr 1 3.6747 -385.50

## - Electricity_Costs 1 3.7056 -383.02

## - age 1 3.7212 -381.76

## - cluster_rent 1 3.9550 -363.67

## - cd_total_07 1 4.1571 -348.87

## - hd_total07 1 4.1591 -348.73

## - Rent 1 9.1204 -115.52

##

## Step: AIC=-396.73

## green_rent ~ empl_gr + Rent + age + renovated + class_a + class_b +

## Energystar + amenities + cd_total_07 + hd_total07 + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - class_b 1 3.5508 -401.39

## - class_a 1 3.5518 -401.31

## - renovated 1 3.5530 -401.21

## - amenities 1 3.5641 -400.28

## - Energystar 1 3.5748 -399.39

## <none> 3.5384 -396.73

## - empl_gr 1 3.6750 -391.18

## - Electricity_Costs 1 3.7129 -388.13

## - age 1 3.7241 -387.24

## - cluster_rent 1 3.9578 -369.16

## - cd_total_07 1 4.1575 -354.55

## - hd_total07 1 4.1608 -354.31

## - Rent 1 9.3379 -114.22

##

## Step: AIC=-401.39

## green_rent ~ empl_gr + Rent + age + renovated + class_a + Energystar +

## amenities + cd_total_07 + hd_total07 + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - class_a 1 3.5518 -407.01

## - renovated 1 3.5631 -406.07

## - amenities 1 3.5724 -405.29

## - Energystar 1 3.5842 -404.31

## <none> 3.5508 -401.39

## - empl_gr 1 3.6775 -396.68

## - age 1 3.7277 -392.66

## - Electricity_Costs 1 3.7471 -391.12

## - cluster_rent 1 3.9689 -374.03

## - cd_total_07 1 4.1662 -359.63

## - hd_total07 1 4.2058 -356.82

## - Rent 1 9.4061 -117.77

##

## Step: AIC=-407.01

## green_rent ~ empl_gr + Rent + age + renovated + Energystar +

## amenities + cd_total_07 + hd_total07 + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - renovated 1 3.5636 -411.73

## - amenities 1 3.5725 -410.99

## - Energystar 1 3.5857 -409.90

## <none> 3.5518 -407.01

## - empl_gr 1 3.6779 -402.36

## - age 1 3.7435 -397.10

## - Electricity_Costs 1 3.7472 -396.81

## - cluster_rent 1 3.9725 -379.47

## - cd_total_07 1 4.1702 -365.05

## - hd_total07 1 4.2084 -362.34

## - Rent 1 9.5318 -119.53

##

## Step: AIC=-411.73

## green_rent ~ empl_gr + Rent + age + Energystar + amenities +

## cd_total_07 + hd_total07 + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - amenities 1 3.5886 -415.36

## - Energystar 1 3.6010 -414.34

## <none> 3.5636 -411.73

## - empl_gr 1 3.6890 -407.17

## - age 1 3.7514 -402.18

## - Electricity_Costs 1 3.7671 -400.94

## - cluster_rent 1 3.9822 -384.45

## - cd_total_07 1 4.1969 -368.85

## - hd_total07 1 4.2463 -365.38

## - Rent 1 9.5593 -124.37

##

## Step: AIC=-415.36

## green_rent ~ empl_gr + Rent + age + Energystar + cd_total_07 +

## hd_total07 + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - Energystar 1 3.6165 -418.76

## <none> 3.5886 -415.36

## - empl_gr 1 3.7033 -411.72

## - age 1 3.7752 -406.01

## - Electricity_Costs 1 3.8161 -402.81

## - cluster_rent 1 4.0380 -386.02

## - cd_total_07 1 4.2336 -371.97

## - hd_total07 1 4.2768 -368.96

## - Rent 1 9.5610 -130.02

##

## Step: AIC=-418.76

## green_rent ~ empl_gr + Rent + age + cd_total_07 + hd_total07 +

## Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## <none> 3.6165 -418.76

## - empl_gr 1 3.7259 -415.62

## - age 1 3.7837 -411.04

## - Electricity_Costs 1 3.8323 -407.26

## - cluster_rent 1 4.0672 -389.58

## - cd_total_07 1 4.2357 -377.53

## - hd_total07 1 4.2770 -374.64

## - Rent 1 9.6322 -133.53

regForward = step(null, #The most simple model

scope=formula(full), #The most complicated model

direction="both", #Add or delete variables

k=log(length(tr))) #This is BIC## Start: AIC=-553.32

## green_rent ~ 1

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 297/300 rows from a combined fit

## Df Sum of Sq RSS AIC

## + Rent 1 40.380 5.642 -1165.74

## + cluster_rent 1 35.285 10.737 -974.65

## + total_dd_07 1 10.720 35.302 -621.14

## + Electricity_Costs 1 7.482 38.540 -595.07

## + hd_total07 1 4.375 41.648 -572.05

## + cd_total_07 1 3.665 42.357 -567.03

## + class_b 1 1.707 44.315 -553.61

## + class_a 1 1.658 44.364 -553.28

## <none> 46.022 -548.08

## + net 1 0.665 45.357 -546.70

## + leasing_rate 1 0.630 45.392 -546.48

## + Precipitation 1 0.454 45.568 -545.33

## + Gas_Costs 1 0.420 45.603 -545.10

## + amenities 1 0.309 45.714 -544.38

## + age 1 0.219 45.803 -543.80

## + stories 1 0.186 45.837 -543.58

## + empl_gr 1 0.138 45.884 -543.27

## + renovated 1 0.056 45.966 -542.74

## + Energystar 1 0.015 46.007 -542.48

## + LEED 1 0.004 46.019 -542.40

##

## Step: AIC=-1180.55

## green_rent ~ Rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 297/300 rows from a combined fit

## Df Sum of Sq RSS AIC

## + total_dd_07 1 0.950 4.692 -1214.81

## + cluster_rent 1 0.810 4.832 -1206.05

## + hd_total07 1 0.519 5.124 -1188.67

## <none> 5.644 -1180.55

## + age 1 0.264 5.378 -1174.26

## + Precipitation 1 0.195 5.447 -1170.51

## + cd_total_07 1 0.125 5.517 -1166.69

## + Gas_Costs 1 0.115 5.527 -1166.15

## + Electricity_Costs 1 0.070 5.573 -1163.72

## + amenities 1 0.065 5.578 -1163.46

## + empl_gr 1 0.062 5.580 -1163.32

## + stories 1 0.058 5.584 -1163.11

## + LEED 1 0.056 5.586 -1163.01

## + Energystar 1 0.045 5.597 -1162.41

## + class_b 1 0.026 5.616 -1161.42

## + class_a 1 0.025 5.617 -1161.36

## + net 1 0.017 5.626 -1160.91

## + leasing_rate 1 0.000 5.642 -1160.06

## + renovated 1 0.000 5.642 -1160.06

## - Rent 1 40.899 46.542 -553.32

##

## Step: AIC=-1228.78

## green_rent ~ Rent + total_dd_07

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 297/300 rows from a combined fit

## Df Sum of Sq RSS AIC

## + cluster_rent 1 0.4453 4.247 -1238.72

## + Electricity_Costs 1 0.3208 4.371 -1230.14

## <none> 4.715 -1228.78

## + age 1 0.2045 4.487 -1222.34

## + empl_gr 1 0.1689 4.523 -1220.00

## + amenities 1 0.0624 4.630 -1213.08

## + class_b 1 0.0477 4.644 -1212.14

## + class_a 1 0.0474 4.645 -1212.12

## + Gas_Costs 1 0.0097 4.682 -1209.72

## + Precipitation 1 0.0035 4.688 -1209.33

## + cd_total_07 1 0.0030 4.689 -1209.30

## + hd_total07 1 0.0030 4.689 -1209.30

## + renovated 1 0.0023 4.690 -1209.25

## + stories 1 0.0012 4.691 -1209.19

## + LEED 1 0.0003 4.692 -1209.13

## + Energystar 1 0.0003 4.692 -1209.12

## + net 1 0.0002 4.692 -1209.12

## + leasing_rate 1 0.0001 4.692 -1209.11

## - total_dd_07 1 0.9286 5.644 -1180.55

## - Rent 1 31.3563 36.072 -624.08

##

## Step: AIC=-1253.43

## green_rent ~ Rent + total_dd_07 + cluster_rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 297/300 rows from a combined fit

## Df Sum of Sq RSS AIC

## + Electricity_Costs 1 0.3399 3.9067 -1257.80

## <none> 4.2615 -1253.43

## + age 1 0.2400 4.0066 -1250.30

## + empl_gr 1 0.1399 4.1067 -1242.97

## + class_b 1 0.0603 4.1863 -1237.27

## + class_a 1 0.0570 4.1896 -1237.04

## + Gas_Costs 1 0.0471 4.1995 -1236.33

## + amenities 1 0.0331 4.2135 -1235.35

## + Precipitation 1 0.0200 4.2267 -1234.42

## + stories 1 0.0190 4.2276 -1234.35

## + renovated 1 0.0039 4.2428 -1233.29

## + cd_total_07 1 0.0012 4.2454 -1233.10

## + hd_total07 1 0.0012 4.2454 -1233.10

## + leasing_rate 1 0.0011 4.2455 -1233.10

## + LEED 1 0.0002 4.2465 -1233.03

## + net 1 0.0001 4.2465 -1233.03

## + Energystar 1 0.0000 4.2466 -1233.02

## - cluster_rent 1 0.4538 4.7153 -1228.78

## - total_dd_07 1 0.5917 4.8532 -1220.13

## - Rent 1 6.0523 10.3138 -993.98

##

## Step: AIC=-1267.83

## green_rent ~ Rent + total_dd_07 + cluster_rent + Electricity_Costs

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 297/300 rows from a combined fit

## Df Sum of Sq RSS AIC

## <none> 3.9853 -1267.83

## + age 1 0.1806 3.7261 -1266.15

## + empl_gr 1 0.1083 3.7984 -1260.45

## + class_a 1 0.0270 3.8797 -1254.16

## + class_b 1 0.0248 3.8819 -1253.99

## + Precipitation 1 0.0222 3.8845 -1253.79

## - Electricity_Costs 1 0.2762 4.2615 -1253.43

## + amenities 1 0.0092 3.8976 -1252.79

## + renovated 1 0.0057 3.9010 -1252.53

## + stories 1 0.0050 3.9017 -1252.48

## + Energystar 1 0.0047 3.9020 -1252.45

## + LEED 1 0.0038 3.9030 -1252.38

## + leasing_rate 1 0.0030 3.9038 -1252.32

## + cd_total_07 1 0.0021 3.9046 -1252.26

## + hd_total07 1 0.0021 3.9046 -1252.26

## + Gas_Costs 1 0.0004 3.9063 -1252.12

## + net 1 0.0001 3.9067 -1252.10

## - cluster_rent 1 0.4902 4.4754 -1238.74

## - total_dd_07 1 0.8607 4.8459 -1214.88

## - Rent 1 6.1982 10.1835 -992.09

#Step: AIC=-1319.5 green_rent ~ Rent + total_dd_07 + Electricity_Costs + cluster_rentnot_green = subset(green, green_rating==0)

dim(not_green)## [1] 7209 23

#Let us use the log response

not_green_rent <- log(not_green$Rent)

#subset of dataset for simplicity, dont do this try to include all in dataset

not_green_sub <- not_green[,-c(0,1,2,3)] # lose lmedval and the room totals

n = dim(not_green_sub)[1] #Sample size

tr = sample(1:n, #Sample indices do be used in training

size = 3000, #Sample will have 5000 observation

replace = FALSE) #Without replacement

#Create a full matrix of interactions (only necessary for linear model)

#Do the normalization only for main variables.

xxnot_green_sub <- model.matrix(~., data=data.frame(scale(not_green_sub)))[,-1] # the . syntax multiplies data by each long and lat, and then by both

notgreenData = data.frame(not_green_rent,not_green_sub)

#Two models initially, sets the scope/boundaries for search

null = lm(not_green_rent~1, data=notgreenData[tr,]) #only has an intercept

full = glm(not_green_rent~., data=notgreenData[tr,]) #Has all the selected variables

#Let us select models by stepwise

regBack = step(full, #Starting with the full model

direction="backward", #And deleting variables

k=log(length(tr))) #This is BIC## Start: AIC=-2270.29

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + green_rating +

## net + amenities + cd_total_07 + hd_total07 + total_dd_07 +

## Precipitation + Gas_Costs + Electricity_Costs + cluster_rent

##

##

## Step: AIC=-2270.29

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + green_rating +

## net + amenities + cd_total_07 + hd_total07 + Precipitation +

## Gas_Costs + Electricity_Costs + cluster_rent

##

##

## Step: AIC=-2270.29

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + Energystar + net +

## amenities + cd_total_07 + hd_total07 + Precipitation + Gas_Costs +

## Electricity_Costs + cluster_rent

##

##

## Step: AIC=-2270.29

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + LEED + net + amenities +

## cd_total_07 + hd_total07 + Precipitation + Gas_Costs + Electricity_Costs +

## cluster_rent

##

##

## Step: AIC=-2270.29

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + net + amenities + cd_total_07 +

## hd_total07 + Precipitation + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - net 1 77.398 -2277.67

## - stories 1 77.400 -2277.58

## - leasing_rate 1 77.413 -2277.10

## - renovated 1 77.547 -2271.96

## - Precipitation 1 77.567 -2271.20

## <none> 77.382 -2270.29

## - amenities 1 77.627 -2268.91

## - class_b 1 77.704 -2265.95

## - empl_gr 1 77.824 -2261.36

## - class_a 1 77.960 -2256.15

## - age 1 78.317 -2242.59

## - Electricity_Costs 1 78.576 -2232.76

## - Gas_Costs 1 78.590 -2232.24

## - hd_total07 1 82.118 -2101.74

## - cd_total_07 1 82.767 -2078.36

## - cluster_rent 1 90.388 -1816.56

## - Rent 1 192.838 435.44

##

## Step: AIC=-2277.67

## not_green_rent ~ empl_gr + Rent + leasing_rate + stories + age +

## renovated + class_a + class_b + amenities + cd_total_07 +

## hd_total07 + Precipitation + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## - stories 1 77.416 -2285.00

## - leasing_rate 1 77.429 -2284.48

## - renovated 1 77.563 -2279.36

## - Precipitation 1 77.583 -2278.59

## <none> 77.398 -2277.67

## - amenities 1 77.645 -2276.22

## - class_b 1 77.716 -2273.48

## - empl_gr 1 77.841 -2268.70

## - class_a 1 77.968 -2263.87

## - age 1 78.330 -2250.11

## - Gas_Costs 1 78.597 -2239.99

## - Electricity_Costs 1 78.640 -2238.36

## - hd_total07 1 82.204 -2106.63

## - cd_total_07 1 82.842 -2083.67

## - cluster_rent 1 90.448 -1822.59

## - Rent 1 193.246 433.71

##

## Step: AIC=-2285

## not_green_rent ~ empl_gr + Rent + leasing_rate + age + renovated +

## class_a + class_b + amenities + cd_total_07 + hd_total07 +

## Precipitation + Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - leasing_rate 1 77.451 -2291.64

## - Precipitation 1 77.586 -2286.48

## - renovated 1 77.589 -2286.34

## <none> 77.416 -2285.00

## - amenities 1 77.697 -2282.21

## - class_b 1 77.750 -2280.21

## - empl_gr 1 77.866 -2275.77

## - class_a 1 78.124 -2265.92

## - age 1 78.343 -2257.61

## - Gas_Costs 1 78.597 -2247.99

## - Electricity_Costs 1 78.642 -2246.31

## - hd_total07 1 82.317 -2110.57

## - cd_total_07 1 82.843 -2091.62

## - cluster_rent 1 90.539 -1827.62

## - Rent 1 193.932 436.24

##

## Step: AIC=-2291.64

## not_green_rent ~ empl_gr + Rent + age + renovated + class_a +

## class_b + amenities + cd_total_07 + hd_total07 + Precipitation +

## Gas_Costs + Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - Precipitation 1 77.629 -2292.83

## - renovated 1 77.631 -2292.74

## <none> 77.451 -2291.64

## - amenities 1 77.764 -2287.69

## - class_b 1 77.818 -2285.59

## - empl_gr 1 77.897 -2282.58

## - class_a 1 78.223 -2270.16

## - age 1 78.384 -2264.08

## - Gas_Costs 1 78.667 -2253.34

## - Electricity_Costs 1 78.682 -2252.78

## - hd_total07 1 82.323 -2118.34

## - cd_total_07 1 82.924 -2096.73

## - cluster_rent 1 90.757 -1828.46

## - Rent 1 194.344 434.53

##

## Step: AIC=-2292.83

## not_green_rent ~ empl_gr + Rent + age + renovated + class_a +

## class_b + amenities + cd_total_07 + hd_total07 + Gas_Costs +

## Electricity_Costs + cluster_rent

##

## Df Deviance AIC

## - renovated 1 77.793 -2294.57

## <none> 77.629 -2292.83

## - amenities 1 77.919 -2289.74

## - class_b 1 78.034 -2285.39

## - class_a 1 78.404 -2271.31

## - empl_gr 1 78.532 -2266.47

## - age 1 78.654 -2261.86

## - Electricity_Costs 1 78.689 -2260.52

## - Gas_Costs 1 78.803 -2256.24

## - hd_total07 1 82.651 -2114.53

## - cd_total_07 1 83.431 -2086.61

## - cluster_rent 1 91.370 -1816.48

## - Rent 1 194.364 426.83

##

## Step: AIC=-2294.57

## not_green_rent ~ empl_gr + Rent + age + class_a + class_b + amenities +

## cd_total_07 + hd_total07 + Gas_Costs + Electricity_Costs +

## cluster_rent

##

## Df Deviance AIC

## <none> 77.793 -2294.57

## - amenities 1 78.127 -2289.86

## - class_b 1 78.270 -2284.41

## - age 1 78.658 -2269.71

## - class_a 1 78.673 -2269.15

## - empl_gr 1 78.678 -2268.94

## - Electricity_Costs 1 78.933 -2259.34

## - Gas_Costs 1 79.002 -2256.72

## - hd_total07 1 83.116 -2105.87

## - cd_total_07 1 83.719 -2084.40

## - cluster_rent 1 91.401 -1823.49

## - Rent 1 194.491 420.78

regForward = step(null, #The most simple model

scope=formula(full), #The most complicated model

direction="both", #Add or delete variables

k=log(length(tr))) #This is BIC## Start: AIC=-4798.99

## not_green_rent ~ 1

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2972/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + Rent 1 487.50 111.89 -9730.6

## + cluster_rent 1 378.32 221.07 -7706.8

## + Electricity_Costs 1 129.23 470.16 -5464.1

## + total_dd_07 1 80.41 518.98 -5170.5

## + hd_total07 1 41.17 558.21 -4953.9

## + class_a 1 34.46 564.92 -4918.4

## + cd_total_07 1 22.01 577.37 -4853.6

## + leasing_rate 1 21.22 578.17 -4849.5

## + age 1 16.53 582.86 -4825.5

## + class_b 1 9.70 589.69 -4790.9

## + renovated 1 9.07 590.32 -4787.7

## + stories 1 4.24 595.15 -4763.5

## <none> 599.39 -4750.4

## + amenities 1 1.22 598.17 -4748.5

## + net 1 0.79 598.60 -4746.3

## + Precipitation 1 0.38 599.00 -4744.3

## + Gas_Costs 1 0.25 599.13 -4743.7

## + empl_gr 1 0.06 599.32 -4742.7

##

## Step: AIC=-9841.71

## not_green_rent ~ Rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2972/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + cluster_rent 1 19.52 92.37 -10292.3

## + total_dd_07 1 13.52 98.36 -10105.5

## + hd_total07 1 8.27 103.62 -9950.8

## + Electricity_Costs 1 5.27 106.62 -9866.0

## <none> 112.22 -9841.7

## + age 1 3.22 108.67 -9809.3

## + class_a 1 2.10 109.79 -9778.9

## + cd_total_07 1 1.87 110.02 -9772.7

## + Precipitation 1 0.91 110.98 -9746.9

## + leasing_rate 1 0.63 111.26 -9739.3

## + class_b 1 0.16 111.73 -9726.8

## + empl_gr 1 0.14 111.75 -9726.3

## + renovated 1 0.13 111.76 -9726.0

## + amenities 1 0.10 111.79 -9725.3

## + stories 1 0.08 111.81 -9724.7

## + net 1 0.02 111.86 -9723.3

## + Gas_Costs 1 0.00 111.89 -9722.6

## - Rent 1 492.06 604.28 -4799.0

##

## Step: AIC=-10399.65

## not_green_rent ~ Rent + cluster_rent

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2972/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## + total_dd_07 1 6.300 86.071 -10494.3

## + age 1 4.001 88.370 -10415.9

## + hd_total07 1 3.851 88.520 -10410.9

## <none> 92.927 -10399.7

## + class_a 1 3.120 89.251 -10386.4

## + Precipitation 1 1.230 91.141 -10324.2

## + amenities 1 1.104 91.267 -10320.0

## + cd_total_07 1 0.696 91.675 -10306.8

## + Electricity_Costs 1 0.443 91.928 -10298.6

## + leasing_rate 1 0.425 91.946 -10298.0

## + class_b 1 0.253 92.118 -10292.5

## + empl_gr 1 0.203 92.168 -10290.8

## + stories 1 0.170 92.201 -10289.8

## + Gas_Costs 1 0.021 92.350 -10285.0

## + renovated 1 0.013 92.358 -10284.7

## + net 1 0.013 92.359 -10284.7

## - cluster_rent 1 19.293 112.220 -9841.7

## - Rent 1 130.928 223.854 -7770.1

##

## Step: AIC=-10599.07

## not_green_rent ~ Rent + cluster_rent + total_dd_07

## Warning in add1.lm(fit, scope$add, scale = scale, trace = trace, k = k, : using

## the 2972/3000 rows from a combined fit

## Df Sum of Sq RSS AIC

## <none> 86.719 -10599.1

## + class_a 1 3.130 82.941 -10596.3

## + age 1 2.993 83.078 -10591.4

## + amenities 1 1.669 84.402 -10544.5

## + Electricity_Costs 1 1.448 84.623 -10536.7

## + stories 1 0.951 85.121 -10519.3

## + leasing_rate 1 0.618 85.453 -10507.7

## + empl_gr 1 0.460 85.611 -10502.2

## + class_b 1 0.295 85.776 -10496.5

## + Gas_Costs 1 0.158 85.913 -10491.7

## + cd_total_07 1 0.059 86.012 -10488.3

## + hd_total07 1 0.059 86.012 -10488.3

## + renovated 1 0.019 86.052 -10486.9

## + Precipitation 1 0.005 86.067 -10486.4

## + net 1 0.004 86.068 -10486.4

## - total_dd_07 1 6.208 92.927 -10399.7

## - cluster_rent 1 12.182 98.901 -10212.7

## - Rent 1 133.488 220.206 -7811.4

#Step: AIC=-11140.9

not_green_rent ~ Rent + total_dd_07 + cluster_rent + Electricity_Costs +

age## not_green_rent ~ Rent + total_dd_07 + cluster_rent + Electricity_Costs +

## age

hist(not_green$Rent, 25)mean(not_green$Rent)## [1] 28.26678

hist(green_only$Rent, 25)mean(green_only$Rent)## [1] 30.01603

xbar = mean(green_only$Rent)

sig_hat = sd(green_only$Rent)

se_hat = sig_hat/sqrt(nrow(green_only))

xbar + c(-1.96,1.96)*se_hat## [1] 29.04623 30.98583

#normal confidence interval for sample meanmodel1 = lm(Rent ~ 1, data=green_only)

confint(model1, level=0.95)## 2.5 % 97.5 %

## (Intercept) 29.04453 30.98753

#bootstrapping

library(mosaic)## Warning: package 'mosaic' was built under R version 4.0.2

## Loading required package: dplyr

## Warning: package 'dplyr' was built under R version 4.0.2

##

## Attaching package: 'dplyr'

## The following objects are masked from 'package:stats':

##

## filter, lag

## The following objects are masked from 'package:base':

##

## intersect, setdiff, setequal, union

## Loading required package: lattice

## Loading required package: ggformula

## Warning: package 'ggformula' was built under R version 4.0.2

## Loading required package: ggplot2

## Loading required package: ggstance

## Warning: package 'ggstance' was built under R version 4.0.2

##

## Attaching package: 'ggstance'

## The following objects are masked from 'package:ggplot2':

##

## geom_errorbarh, GeomErrorbarh

##

## New to ggformula? Try the tutorials:

## learnr::run_tutorial("introduction", package = "ggformula")

## learnr::run_tutorial("refining", package = "ggformula")

## Loading required package: mosaicData

## Warning: package 'mosaicData' was built under R version 4.0.2

## Loading required package: Matrix

## Registered S3 method overwritten by 'mosaic':

## method from

## fortify.SpatialPolygonsDataFrame ggplot2

##

## The 'mosaic' package masks several functions from core packages in order to add

## additional features. The original behavior of these functions should not be affected by this.

##

## Note: If you use the Matrix package, be sure to load it BEFORE loading mosaic.

##

## Have you tried the ggformula package for your plots?

##

## Attaching package: 'mosaic'

## The following object is masked from 'package:Matrix':

##

## mean

## The following object is masked from 'package:ggplot2':

##

## stat

## The following objects are masked from 'package:dplyr':

##

## count, do, tally

## The following objects are masked from 'package:stats':

##

## binom.test, cor, cor.test, cov, fivenum, IQR, median, prop.test,

## quantile, sd, t.test, var

## The following objects are masked from 'package:base':

##

## max, mean, min, prod, range, sample, sum

green_only_boot = resample(green_only)

mean(green_only_boot$Rent)## [1] 29.83156

model2 = lm(Rent ~ 1, data=not_green)

confint(model2, level=0.95)## 2.5 % 97.5 %

## (Intercept) 27.91459 28.61896

green_all_boot = resample(not_green)

mean(not_green$Rent)## [1] 28.26678

##Summary

Some exploratory data to get a feel for the dataset. We can understand here the relationship between rent for green buildings and rent for not buildings. It is confirmed here that the difference between the rent prices exists for green biuldings and not green buidlings. At a 97.5% confidence interval, we are able to see that the interval for rent prices for not green buildings does not overlap with the green interval rents, showing that there is a higher cost (or more revenue) from having a green building. However, is it because it is green, or some other variable in the background that is correlated with green buildings, that drives up rent prices?

To take a deeper look at this, I decided to do a stepwise regression model for: all buildings, green only, and not green buildings to see what variables impacted rent the most, and if there were any changes or patterns among these.

For all buildings, we had an AIC=-10971.86 rent_all ~ Rent + total_dd_07 + cluster_rent + Electricity_Costs + age

It seems for all buildings, what impacts rent the most would be: * the age of a building, which makes sense, the older the building, the more depreciated, and the less valued by customers and the market * cluster rent (a measure of average rent per square-foot per calendar year in the building’s local market) which makes sense, because if the market is in new york, it will be more expensive than texas * total.dd.07 the total number of degree days (either heating or cooling) in the building’s region in 2007, this one seemed not as obvious to me but, seeing electricity costs is also on here, the correlation between degrees and electricity costs has a correlation of 0.67, showing there is some correlation. the higher it is outside, the colder it will be inside and vice versa * electricity costs makese sense since it is a variable costs and is paid monthly just like rent, can determine the overall amount charged

For green buildings, we had an AIC=-1319.5

green_rent ~ Rent + total_dd_07 + Electricity_Costs + cluster_rent

As explained above, this contains everything but age

To measure if this is different than buildings that are not green we had an AIC=-11140.9 not_green_rent ~ Rent + total_dd_07 + cluster_rent

- Electricity_Costs + age

The only thing that varies from all buildings, not green buildings and the green buildings is that green buildings are not as impacted by age.

As we take the mean and median age for buildings, green_only has a mean age of 23.84526 and a median of 22 while not green buildings are much older with a mean of 49.46733 and a median of 37.

While measuring the correlation between rent price and age it shows only a 0.10, the prices could be determined another way (cluster rent and rent have a correlation of 0.7593399). Having such a big difference in age of buildings could suggest that since green buildings are often newer, they have nicer places and people usually pay more for newer buildings.

However, another reason could be electricity costs. Green buildings have a higher correlation with the total.dd.07 and electricity costs (-0.7178119) than all buildings (-0.657102) and not green buildings (0.6522979). This could suggest that green buildings are impacted more by the heat and therefore use electricity more or less accordingly. Green buildings also have a higher mean average for electricity costs (0.03158175) than non green buildings (0.03089946) showing they do on average spend more on electricity. More electricity usage, more electricity costs and bills, higher rent, and higher revenue. This makes sense because while green buildings try to lower costs such as water, lighting, disposal etc, this is coming from somewhere else (solar panels, different sources of heating) that could affect electricity in different ways or even cause their customers to seek to use more electricity.

I believe there is possibility of confounding variables for the relationship between rent and green status. Affirmed by our stepmodels, green status wasn’t even chosen as a significant variable in any of the samples, showing that it might not be the reason for rent prices.

Furthermore, there’s a lot that goes into rent prices, such as the area you live in, how old the building is, etc. When looking at green buildings, you are looking at newer buildings, and the fact that the building is new could affect the amount you charge for rent. When looking at the energy source changes for green buildings, there is always an effect of redirection of that energy, and that confounding variable could come from the electricity bills.

I believe that the developer should look further into resources to determine what exactly causes rent prices to be higher, and I believe it is not due to it being green, but the effects and attributes that being green has. You do not want to solely base your profit off being green, because following this model, each year you would make less due to the building getting older, or maybe higher electricity costs for the company to maintain being green. You need to see specifically what is causing a higher rent price, and not rely on just being green because background variables are at work here.

cor(green$total_dd_07, green$Electricity_Costs)## [1] -0.657102

mean(green_only$age)## [1] 23.84526

median(green_only$age)## [1] 22

mean(not_green$age)## [1] 49.46733

median(not_green$age)## [1] 37

cor(green$Rent, green$age)## [1] -0.1026638

cor(green$Rent, green$cluster_rent)## [1] 0.7593399

print(cor(green_only$Rent, green_only$Electricity_Costs))## [1] 0.399297

plot(green_only$Rent, green_only$Electricity_Costs)cor(green$Rent, green$Electricity_Costs)## [1] 0.3916586

plot(green$Rent, green$Electricity_Costs)print(cor(green_only$total_dd_07, green_only$Electricity_Costs))## [1] -0.7178119

plot(green_only$total_dd_07, green_only$Electricity_Costs)print(cor(green$total_dd_07, green$Electricity_Costs))## [1] -0.657102

plot(green$total_dd_07, green$Electricity_Costs)print(cor(not_green$total_dd_07, not_green$Electricity_Costs))## [1] -0.6522979

mean(green_only$Electricity_Costs)## [1] 0.03158175

mean(not_green$Electricity_Costs)## [1] 0.03089946

Going more in depth into the previous analysis, we did more data exploration to see if there were more patterns or other ones that strengthened our previous beliefs.

gb <- read.csv("https://raw.githubusercontent.com/jgscott/STA380/master/data/greenbuildings.csv")

head(gb)## CS_PropertyID cluster size empl_gr Rent leasing_rate stories age renovated

## 1 379105 1 260300 2.22 38.56 91.39 14 16 0

## 2 122151 1 67861 2.22 28.57 87.14 5 27 0

## 3 379839 1 164848 2.22 33.31 88.94 13 36 1

## 4 94614 1 93372 2.22 35.00 97.04 13 46 1

## 5 379285 1 174307 2.22 40.69 96.58 16 5 0

## 6 94765 1 231633 2.22 43.16 92.74 14 20 0

## class_a class_b LEED Energystar green_rating net amenities cd_total_07

## 1 1 0 0 1 1 0 1 4988

## 2 0 1 0 0 0 0 1 4988

## 3 0 1 0 0 0 0 1 4988

## 4 0 1 0 0 0 0 0 4988

## 5 1 0 0 0 0 0 1 4988

## 6 1 0 0 0 0 0 1 4988

## hd_total07 total_dd_07 Precipitation Gas_Costs Electricity_Costs

## 1 58 5046 42.57 0.01370000 0.02900000

## 2 58 5046 42.57 0.01373149 0.02904455

## 3 58 5046 42.57 0.01373149 0.02904455

## 4 58 5046 42.57 0.01373149 0.02904455

## 5 58 5046 42.57 0.01373149 0.02904455

## 6 58 5046 42.57 0.01373149 0.02904455

## cluster_rent

## 1 36.78

## 2 36.78

## 3 36.78

## 4 36.78

## 5 36.78

## 6 36.78

gb$green_rating = as.factor(gb$green_rating) There

is large variation and outliners in the dataset. The eco-friendly

building appears to have higher rental rate comparatively, looking at

the same cluster_rent level.

There

is large variation and outliners in the dataset. The eco-friendly

building appears to have higher rental rate comparatively, looking at

the same cluster_rent level.

What percentage of green buildings having a higher rental price than local market rental price? What about percentage of nongreen buildings?

d1 = gb %>%

group_by(green_rating ) %>%

summarize(good_performance = sum(Rent > cluster_rent)/n())## `summarise()` ungrouping output (override with `.groups` argument)

ggplot(data = d1) +

geom_bar(mapping = aes(x = green_rating, y = good_performance ), stat='identity') +

labs(title = "Percentage of Buildings with Higher Rental Rate than Local Market Rental Rate")+

coord_flip() Proportionally, more green buildings have higher than market rental

rate

Proportionally, more green buildings have higher than market rental

rate

gb_filtered = filter(gb, leasing_rate>.1)

gb_filtered %>%

group_by(green_rating) %>%

summarize(Rent.med = median(Rent))## `summarise()` ungrouping output (override with `.groups` argument)

## # A tibble: 2 x 2

## green_rating Rent.med

## <fct> <dbl>

## 1 0 25

## 2 1 27.6

So far the results support the EXCEL guru’s analysis, that green buildings have a higher rental price comparatively. Green Buildings have a 27.6 vs Nongreen Buildings’ 25, but we want to know if green or nongreen causes the difference in price. In another words, how other factors play in determining rental rate?

ggplot(data = gb) +

geom_point(mapping = aes(x = age, y = Rent, color = green_rating))+

labs(title = "Building Rent with different BUilding Age") The green building did not show a strong pattern in higher rent, given

the same building age

The green building did not show a strong pattern in higher rent, given

the same building age

gb %>%

group_by(green_rating) %>%

summarize(renovated.count = count(renovated > 0))## Warning: `data_frame()` is deprecated as of tibble 1.1.0.

## Please use `tibble()` instead.

## This warning is displayed once every 8 hours.

## Call `lifecycle::last_warnings()` to see where this warning was generated.

## `summarise()` ungrouping output (override with `.groups` argument)

## # A tibble: 2 x 2

## green_rating renovated.count

## <fct> <int>

## 1 0 2850

## 2 1 146

gb_filtered = filter(gb, renovated>0)

ggplot(data = gb_filtered) +

geom_point(mapping = aes(x = cluster_rent, y = Rent, color = green_rating),stat='identity') +

labs(title = "Renovated Building in Local Market") If both are renovated, green buildings generally have a higher rental

price than the nongreen buildings in the same local market.

If both are renovated, green buildings generally have a higher rental

price than the nongreen buildings in the same local market.

hist(gb$stories)hist(gb$age)gb_filtered = filter(gb, 20 > stories, stories > 10, age < 25, age > 10)

ggplot(data = gb_filtered) +

geom_point(mapping = aes(x = cluster_rent, y = Rent, color = green_rating)) +

labs(title = "Rent per Square of Green Building and NonGreen Building in Similar Condition")gb_filtered %>%

group_by(green_rating) %>%

summarize(Rent.med = median(Rent))## `summarise()` ungrouping output (override with `.groups` argument)

## # A tibble: 2 x 2

## green_rating Rent.med

## <fct> <dbl>

## 1 0 34.2

## 2 1 34.6

There is a small green building premium but it is not as high as the EXCEL Guru estimated.

So far we have seen how green building appear to have a higher rental rate, but we still cannot prove green building is having a higher rental rate. It could be an indirect results of others factors.

ABIA<- read.csv("https://raw.githubusercontent.com/jgscott/STA380/master/data/ABIA.csv")

View(ABIA)

dim(ABIA)

str(ABIA)##Check the correlation between each variables

library("GGally")

# ggcorr(): Plot a correlation matrix

ggcorr(data = ABIA, palette = "RdYlGn",

label = TRUE, label_color = "black") Carrier Delay and LateAircraf Delay with the 0.6 seem to be more

correlated with Departure Delay and Arrival Delay than any other kinds

of delay, why?

Carrier Delay and LateAircraf Delay with the 0.6 seem to be more

correlated with Departure Delay and Arrival Delay than any other kinds

of delay, why?

library(magrittr)

library(dplyr)

new=ABIA %>% replace(is.na(.), 0)

colMeans(new['CarrierDelay'])## CarrierDelay

## 3.061334

colMeans(new['WeatherDelay'])## WeatherDelay

## 0.4460911

colMeans(new['NASDelay'])## NASDelay

## 2.481251

colMeans(new['SecurityDelay'])## SecurityDelay

## 0.01412452

colMeans(new['LateAircraftDelay'])## LateAircraftDelay

## 4.569051

When we looked at the average delay minutes of each type, we noticed that LateAircraftDelay and CarrierDelay postpone more time. Whatever cause these two types of delay might require more time to deal with. That’s why they are high correlated to DepDelay amd ArrDelay.

##What is the most common reason of delay

new=ABIA %>% replace(is.na(.), 0)

a=colSums(new != 0)

a['CarrierDelay']## CarrierDelay

## 9787

a['WeatherDelay']## WeatherDelay

## 1116

a['NASDelay']## NASDelay

## 10831

a['SecurityDelay']## SecurityDelay

## 78

a['LateAircraftDelay']## LateAircraftDelay

## 10682

The most common reason of delay is actually NASDelay. NAS Delay refers to all airport operations, heavy traffic volume, and flight delays caused by aviation management. By comparison it can probably be solved in a short time.

##The most common reason of cancellation

cancel=dplyr::count(ABIA, CancellationCode, sort = TRUE)

#(A = carrier, B = weather, C = NAS, D = security)

cancel## CancellationCode n

## 1 97840

## 2 A 719

## 3 B 605

## 4 C 96

According to the count of cacellation code, Carrier Delay is the most common reason.The fligts delay due to reasons such as emergency maintenance of the aircraft, crew deployment, baggage storage, and aircraft filling in fuel.

So suprised the most common reason of delay was not weather.

##Flights each month

hist(x=ABIA$Month,

main="Flights each Month",

xlab="Month",

ylab="Frequency")  More flights during summer, probably because of the summer vacation.

(May~July)

More flights during summer, probably because of the summer vacation.

(May~July)

##Flights each weekdays

week <- group_by(ABIA, DayOfWeek)

count <- summarise(week,count = n())

count## # A tibble: 7 x 2

## DayOfWeek count

## <int> <int>

## 1 1 14798

## 2 2 14803

## 3 3 14841

## 4 4 14774

## 5 5 14768

## 6 6 11454

## 7 7 13822

hist(x=ABIA$DayOfWeek,

main="Flights each week day",

xlab="week",

ylab="Frequency") ##Flights to Austin

to_austin=ABIA[ABIA$Dest == 'AUS',]

dplyr::count(to_austin, Origin, sort = TRUE)## Origin n

## 1 DAL 5583

## 2 DFW 5508

## 3 IAH 3704

## 4 PHX 2786

## 5 DEN 2719

## 6 ORD 2515

## 7 HOU 2310

## 8 ATL 2255

## 9 LAX 1732

## 10 JFK 1356

## 11 ELP 1344

## 12 LAS 1232

## 13 SJC 968

## 14 EWR 939

## 15 MEM 835

## 16 BNA 795

## 17 BWI 728

## 18 SAN 715

## 19 MDW 713

## 20 LBB 690

## 21 CLT 660

## 22 CVG 653

## 23 MCO 632

## 24 IAD 631

## 25 SFO 609

## 26 SLC 550

## 27 FLL 481

## 28 MAF 471

## 29 MCI 459

## 30 MSY 443

## 31 ABQ 433

## 32 CLE 380

## 33 BOS 368

## 34 TPA 367

## 35 HRL 366

## 36 ONT 304

## 37 PHL 290

## 38 SNA 246

## 39 LGB 245

## 40 OAK 236

## 41 RDU 231

## 42 JAX 229

## 43 TUS 229

## 44 IND 218

## 45 SEA 147

## 46 STL 95

## 47 TUL 90

## 48 OKC 87

## 49 MSP 54

## 50 TYS 3

## 51 SAT 2

## 52 BHM 1

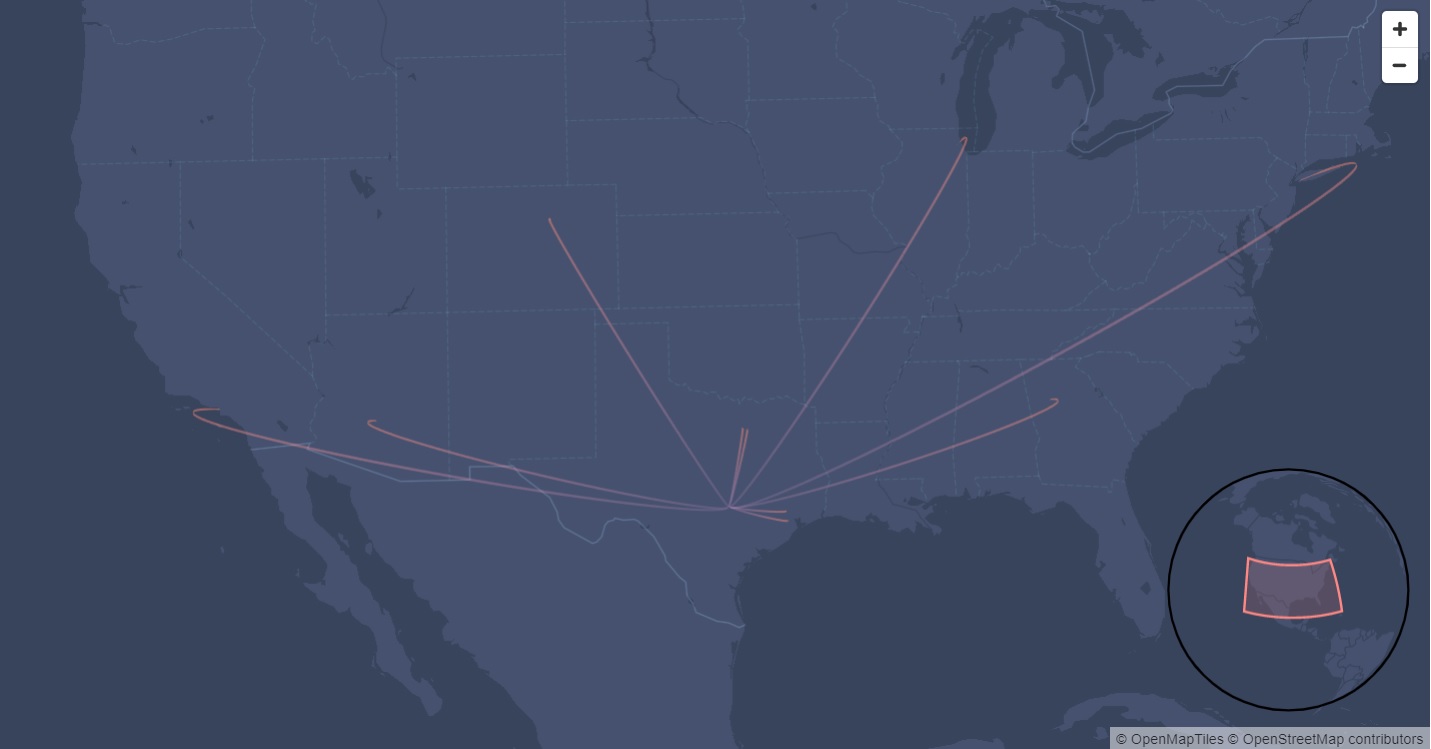

Top three numbers of flights are from two Dallas airports and Houston.

##fly from Austin

away_austin=ABIA[ABIA$Origin == 'AUS',]

dplyr::count(away_austin, Dest, sort = TRUE)## Dest n

## 1 DAL 5573

## 2 DFW 5506

## 3 IAH 3691

## 4 PHX 2783

## 5 DEN 2673

## 6 ORD 2514

## 7 HOU 2319

## 8 ATL 2252

## 9 LAX 1733

## 10 JFK 1358

## 11 ELP 1349

## 12 LAS 1231

## 13 SJC 968

## 14 EWR 949

## 15 MEM 834

## 16 BNA 792

## 17 BWI 730

## 18 SAN 719

## 19 MDW 712

## 20 LBB 692

## 21 IAD 670

## 22 CLT 659

## 23 CVG 653

## 24 MCO 632

## 25 SFO 610

## 26 SLC 548

## 27 FLL 481

## 28 MAF 470

## 29 MCI 459

## 30 MSY 444

## 31 ABQ 435

## 32 CLE 380

## 33 BOS 368

## 34 HRL 367

## 35 TPA 367

## 36 ONT 305

## 37 PHL 290

## 38 LGB 245

## 39 SNA 245

## 40 OAK 236

## 41 RDU 231

## 42 TUS 228

## 43 JAX 226

## 44 IND 218

## 45 SEA 149

## 46 STL 95

## 47 OKC 88

## 48 TUL 88

## 49 MSP 55

## 50 DSM 1

## 51 DTW 1

## 52 ORF 1

Top three for flghts fly from Austin remain the same.

densityplot( ~ Distance ,

data=ABIA

) Mostly are short distance flghts less than 500 miles

Mostly are short distance flghts less than 500 miles

boxplot(formula = AirTime ~ UniqueCarrier,

data = ABIA,

xlab = "Carriers code",

ylab = "Airtime(min)",

col ="blue")  B6 is JetBlue. This carrier seems to fly logner air time in minutes. Is

it because its destinations tend to be farer?

B6 is JetBlue. This carrier seems to fly logner air time in minutes. Is

it because its destinations tend to be farer?

b=summarise(group_by(new, UniqueCarrier), count(UniqueCarrier))## `summarise()` ungrouping output (override with `.groups` argument)

b## # A tibble: 16 x 2

## UniqueCarrier `count(UniqueCarrier)`

## <chr> <int>

## 1 9E 2549

## 2 AA 19995

## 3 B6 4798

## 4 CO 9230

## 5 DL 2134

## 6 EV 825

## 7 F9 2132

## 8 MQ 2663

## 9 NW 121

## 10 OH 2986

## 11 OO 4015

## 12 UA 1866

## 13 US 1458

## 14 WN 34876

## 15 XE 4618

## 16 YV 4994

##Average miles of each carriers

c=summarise(group_by(new, UniqueCarrier), sum(Distance))## `summarise()` ungrouping output (override with `.groups` argument)

c## # A tibble: 16 x 2

## UniqueCarrier `sum(Distance)`

## <chr> <int>

## 1 9E 1705226

## 2 AA 12786743

## 3 B6 6814746

## 4 CO 3867432

## 5 DL 1734942

## 6 EV 671015

## 7 F9 1652300

## 8 MQ 503307

## 9 NW 120286

## 10 OH 3041637

## 11 OO 3821947

## 12 UA 1979778

## 13 US 1271376

## 14 WN 21212992

## 15 XE 3611113

## 16 YV 5185040

m=merge(c, b, by.x="UniqueCarrier", by.y="UniqueCarrier")

m['frac']=m['sum(Distance)']/m['count(UniqueCarrier)']

m## UniqueCarrier sum(Distance) count(UniqueCarrier) frac

## 1 9E 1705226 2549 668.9784

## 2 AA 12786743 19995 639.4970

## 3 B6 6814746 4798 1420.3306

## 4 CO 3867432 9230 419.0067

## 5 DL 1734942 2134 813.0000

## 6 EV 671015 825 813.3515

## 7 F9 1652300 2132 775.0000

## 8 MQ 503307 2663 189.0000

## 9 NW 120286 121 994.0992

## 10 OH 3041637 2986 1018.6326

## 11 OO 3821947 4015 951.9171

## 12 UA 1979778 1866 1060.9743

## 13 US 1271376 1458 872.0000

## 14 WN 21212992 34876 608.2404

## 15 XE 3611113 4618 781.9647

## 16 YV 5185040 4994 1038.2539

JetBlue tends to fly longer distances. So its total Air time is longest among all carriers.

#Question 3: Portfolio Modeling

- We are buliding 3 different models with different risk levels.

Our chosen ETF’s include SPY, SVXY, QQQ, YYY

YYY - Amplify High Income ETF SPY - One of the safest ETFs SVXY - ProShares VIX Short-Term Futures ETF is high risk QQQ - Ivesco QQQ trust one of the largest IWF - iShares Russell 1000 Growth ETF LGLV -SPDR S TR/RUSSELL 1000 LOW VOLATILI

## Warning: package 'quantmod' was built under R version 4.0.2

## Loading required package: xts

## Warning: package 'xts' was built under R version 4.0.2

## Loading required package: zoo

## Warning: package 'zoo' was built under R version 4.0.2

##

## Attaching package: 'zoo'

## The following objects are masked from 'package:base':

##

## as.Date, as.Date.numeric

##

## Attaching package: 'xts'

## The following objects are masked from 'package:dplyr':

##

## first, last

## Loading required package: TTR

## Warning: package 'TTR' was built under R version 4.0.2

## Registered S3 method overwritten by 'quantmod':

## method from

## as.zoo.data.frame zoo

## Version 0.4-0 included new data defaults. See ?getSymbols.

## Warning: package 'foreach' was built under R version 4.0.2

##

## Attaching package: 'foreach'

## The following objects are masked from 'package:purrr':

##

## accumulate, when

## 'getSymbols' currently uses auto.assign=TRUE by default, but will

## use auto.assign=FALSE in 0.5-0. You will still be able to use

## 'loadSymbols' to automatically load data. getOption("getSymbols.env")

## and getOption("getSymbols.auto.assign") will still be checked for

## alternate defaults.

##

## This message is shown once per session and may be disabled by setting

## options("getSymbols.warning4.0"=FALSE). See ?getSymbols for details.

## pausing 1 second between requests for more than 5 symbols

## pausing 1 second between requests for more than 5 symbols

## [1] "SPY" "SVXY" "QQQ" "YYY" "IWF" "LGLV"

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/SPY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/SPY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=div&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/QQQ?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/QQQ?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/YYY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/YYY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/IWF?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/IWF?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/LGLV?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/LGLV?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## ClCl.SPYa ClCl.SVXYa ClCl.QQQa ClCl.YYYa ClCl.IWFa

## 2007-01-03 NA NA NA NA NA

## 2007-01-04 0.0021221123 NA 0.018963898 NA 0.005618014

## 2007-01-05 -0.0079763183 NA -0.004766296 NA -0.006667922

## 2007-01-08 0.0046250821 NA 0.000684219 NA 0.004354173

## 2007-01-09 -0.0008498831 NA 0.005013605 NA 0.001264433

## 2007-01-10 0.0033315799 NA 0.011791406 NA 0.006855511

## ClCl.LGLVa

## 2007-01-03 NA

## 2007-01-04 NA

## 2007-01-05 NA

## 2007-01-08 NA

## 2007-01-09 NA

## 2007-01-10 NA

The starting wealth value is $100,000

The starting wealth value is $100,000

Simulation 1: Modeling a safe portfolio

ETFs used: “SPY” , “QQQ”, “LGLV”

#### Now use a bootstrap approach

#### With more stocks

mystocks = c("SPY", "SVXY","QQQ","YYY","IWF","LGLV")

myprices = getSymbols(mystocks, from = "2014-01-01")## pausing 1 second between requests for more than 5 symbols

## pausing 1 second between requests for more than 5 symbols

# A chunk of code for adjusting all stocks

# creates a new object adding 'a' to the end

# For example, WMT becomes WMTa, etc

for(ticker in mystocks) {

expr = paste0(ticker, "a = adjustOHLC(", ticker, ")")

eval(parse(text=expr))

}## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/SPY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/SPY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=div&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/SVXY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/QQQ?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/QQQ?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/YYY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/YYY?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query2.finance.yahoo.com/v7/finance/download/IWF?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/IWF?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'

## Warning in read.table(file = file, header = header, sep = sep,

## quote = quote, : incomplete final line found by readTableHeader

## on 'https://query1.finance.yahoo.com/v7/finance/download/LGLV?

## period1=-2208988800&period2=1597708800&interval=1d&events=split&crumb=bIYuOOdYVRY'